If you are thinking of selling your home this spring, now is the time to look around your house and make a plan to de-clutter, organize and clean. When prospective buyers visit your home, you only have one chance to make a first impression. So, putting in some extra effort before you post the “For Sale” sign can make a big difference in both sale price and days on market. Here is a quick list to help you de-clutter and spruce up your house as you prepare to make it “show worthy”:

De-clutter

When buyers enter your house, they are looking for space. Living space. Closet space. Storage space. To help convey space, you will want to pack away belongings you won’t need before the move. This will give you a head start on packing as well as help get your home ready to sell. Consider renting a storage unit to hold boxed possessions and extra furniture. This is also a great time to hold a garage sale or donate unwanted items to charity.

- Clean out your closets, packing away items you won't need before you move and donating those items that are no longer used or needed.

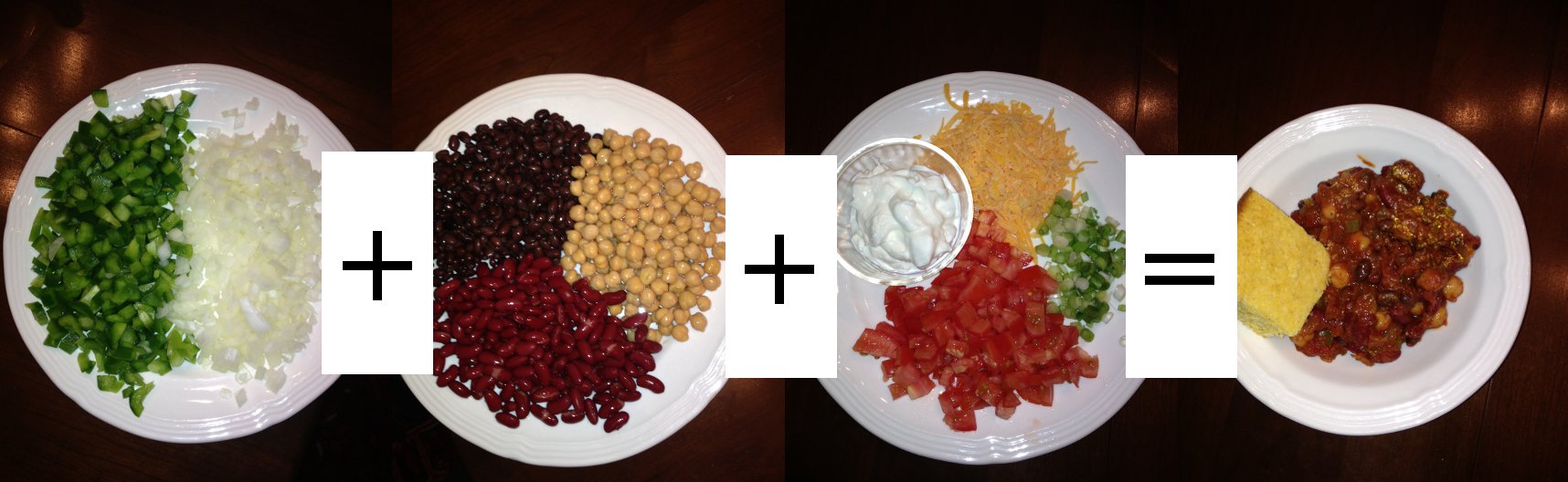

- In the kitchen, throw away old or expired food and clear off the counter tops. Pack away small appliances that take up counter or cabinet space.

- Remove oversized furniture, small tables, extra chairs and “dust collectors” to make your rooms look more spacious.

- Organize the remaining items to show off the space.

Clean

Buyers perceive a clean home as a well-maintained home. Therefore, a home ready to show can never be too clean. Don’t be afraid to break out the white gloves.

- Start with your front door and, yes, doorknobs. Clean and/or paint the door.

- Clean the finger prints from doorknobs and light switches.

- Clean appliances inside and out. Make them shine!

- Clean light and ceiling fan fixtures. Replace burned out light bulbs.

- Clean windows and window screens.

- Steam clean carpets.

- Wipe down baseboards.

- Paint tired walls with a neutral, inviting color.

- Repair or replace damaged walls, fixtures, windows and screens.

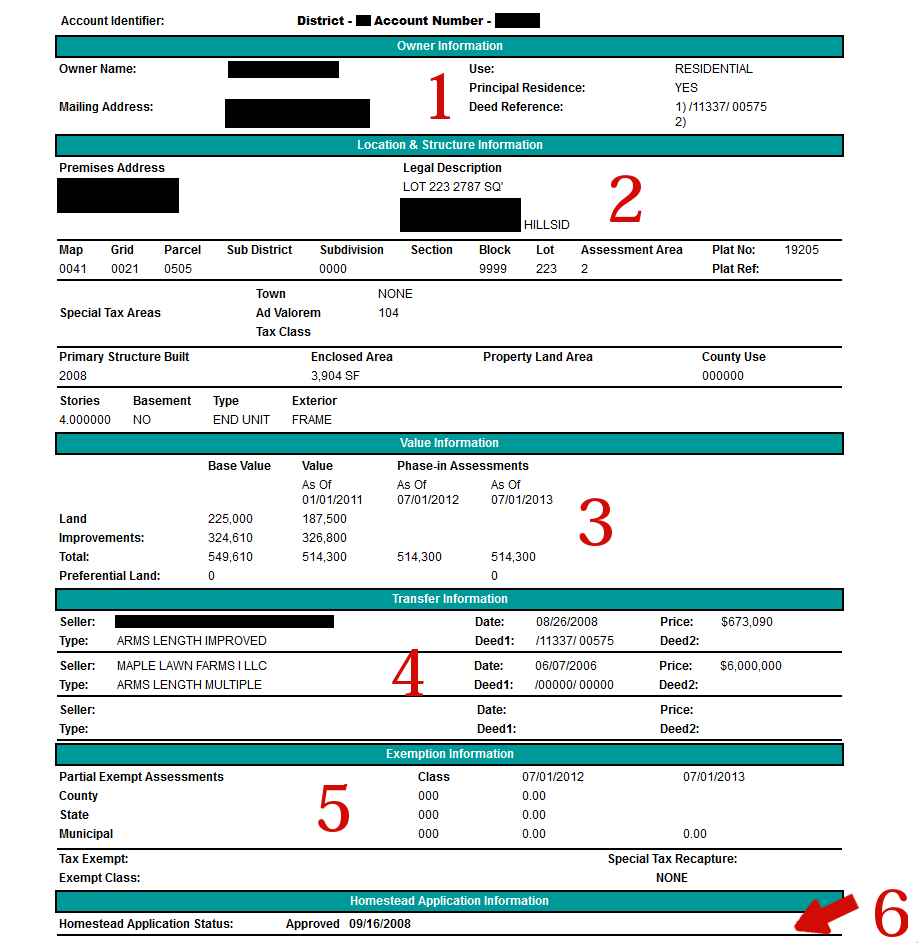

The Wendy Slaughter Team specializes in showcasing our clients’ homes. After we tour your home, we provide a “Home Enhancements Checklist” that outlines those repairs and upgrades that will help you sell for more. We then bring in our professional designer who will stage your home. Finally, we hire a professional photographer to capture and show off your home’s best features.

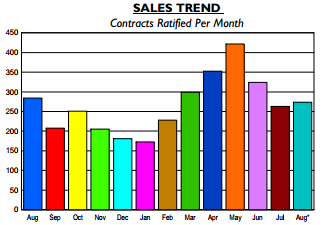

These services help our listings stand out above the competition and are part of our proven marketing formula that helps our clients sell their homes faster. Last year, our Howard County listings sold in an average of 17 days as compared to the county average of 44 days on market. Contact us to help you make your home a “show worthy” addition to the spring market.